Enabling Dual-State Taxation for Existing Employees

How to Enable Dual-State Taxation for Existing Employee in Namely.

OVERVIEW

You can now calculate withholding amounts for employees who live and work in two different states. To enable the dual-state withholding calculation, you’ll need to enter withholding information for the second state and modify the employee’s dual-state taxation status. This article provides instructions on enabling the dual-state withholding calculation for an employee.

Note: Namely does not currently support the ability to split taxable wages within a single pay cycle among two or more states. For example, if an employee works half a pay period in New York and the other half in Georgia, dual-state taxation will not calculate State Income Tax for both states. Dual-State Taxation is only used for states with a reciprocity such as DC and VA.

ENTERING WORK LOCATION AND OPTING IN TO DUAL-STATE TAXATION

Dual-state taxation will only be calculated if an employee has withholding information entered for live-in and work-in locations in different states and if they are opted in for dual-state taxation. By default, employees are not opted into dual-state withholding.

To enable dual-state withholding for an employee, complete the following steps:

Access the Employee Tax Page

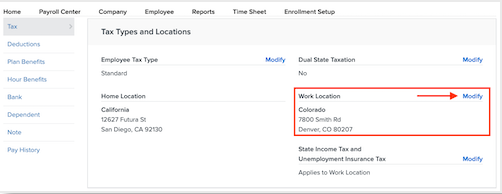

The employee tax page displays the employee’s tax type, dual-state taxation status, home, and work locations, where state income and unemployment insurance tax is applied, federal and state withholding information, and specific taxes paid. All fields can be edited except Home Location, which can be edited on the employee’s HRIS profile.

For more information on the employee tax page, see Adding and Editing Employee Tax Information.

To access the employee tax page:

-

Click Manage Payroll on the Namely homepage.

-

Go to Employee > Search

-

Use the search function to find the employee’s profile.

-

Click Tax on their profile page.

Add a Work Location

To update an employee’s work address:

-

Click Modify next to Work Location.

-

Select an Address.

-

Click Continue.

-

Enter any state-specific withholding information for the work location.

-

Note: If the state allows you to suppress the filing status for the base calculation, the field [State] Suppress Base Calculation will display. You can:

-

Select Additional if you want to calculate based on the filing status and any additional withholding amounts entered.

-

Select Suppress if you want to ignore the filing status and only calculate based on any additional withholding amounts entered.

-

-

Click Finish.

TIP:

When adding a company or employee address for Namely Payroll, please ensure that the address is valid and accurate. Using a made-up address can result in additional taxes being unintentionally calculated as the working and living locations each have taxable ramifications.

Note: If your company will be filing taxes in a new state, you will need to add any required state tax codes in Namely Payroll. For more information, see Adding a New Tax Code to Payroll.

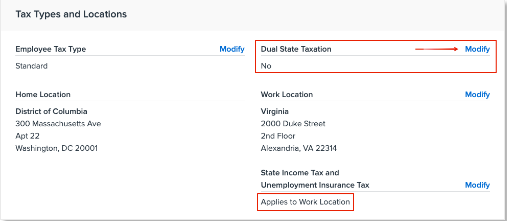

Set ‘Dual State Taxation’ to ‘Yes’

Note: If the employee’s Dual State Taxation field is set to No, the state-withholding information for the second state will still display, but it will not be used for tax calculations.

In order to calculate the employee’s withholding for both work-in and live-in states:

-

Dual State Taxation must be set to Yes.

-

State Income Tax and Unemployment Insurance Tax must be set to Applies to Work Location.

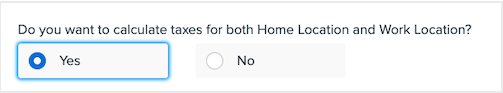

To turn on dual-state taxation:

-

Click Modify next to Dual State Taxation.

-

Select Yes.

-

Click Save.

-

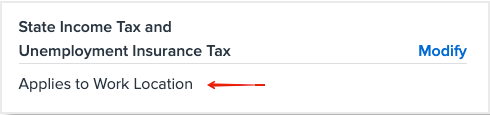

State Income Tax and Unemployment Insurance Tax be defaulted to Applies to Work Location.

-

If it is not, modify this section and select Applies to Work Location.

-

-

Once you have completed the above steps, the employee will have tax withholding amounts calculated for both live-in and work-in locations.

For instructions on how to exclude live-in state tax for existing employees when an employee's live-in state is different than the work-in state and payroll taxes should be paid to the worked-in state, see Excluding Live-In State Tax for Existing Employees.

For more information on deleting and adding employees in a payroll, see Namely Payroll Processing.